Forecasting Air Passenger Volatility Using GARCH Modelling

Published Jun 17, 2023 by Michael Grogan

When attempting to forecast a time series, consideration is given as to both the trend and seasonality patterns in the series.

That said, we can often come across a time series where the volatility in the series is not constant over time. This is known as autoregressive conditional heteroscedasticity.

In this regard, a GARCH model can be used to forecast the volatility in a time series. The purpose of this article is to illustrate how to test for the presence of autoregressive conditional heteroscedasticity using air passenger data sourced from DataSF Open Data and then build a GARCH model to forecast volatility for this time series.

Learn More

Are you interested in learning more about how to forecast business data using time series analysis?

Time series with no ARCH present

To illustrate this better, let us consider a series of normally distributed random numbers in R — formatted as a yearly time series.

df<-rnorm(100)

tsrnorm <- ts(df, start = c(2015,3), frequency = 12)

plot(tsrnorm,type="l",ylab="Values")

title("Values")Plotting this time series yields the following:

Using the ARCH test for univariate time series from the MTS library in R, we can see that the null hypothesis of no presence of conditional heteroscedasticity cannot be rejected at the 5% level of significance, with p-values significantly above 0.05.

> archTest(tsrnorm)

Q(m) of squared series(LM test):

Test statistic: 10.51308 p-value: 0.3966882

Rank-based Test:

Test statistic: 13.04079 p-value: 0.2213999When generating an ARIMA forecast on this series using auto.arima, we can see that an ARIMA(0,0,0) model is selected as the model of best fit — which is in line with what we expect given that the time series generated is essentially white noise.

> fitarima<-auto.arima(tsrnorm, trace=TRUE, test="kpss", ic="bic")

ARIMA(2,0,2)(1,0,1)[12] with non-zero mean : 305.4602

ARIMA(0,0,0) with non-zero mean : 283.2293

ARIMA(1,0,0)(1,0,0)[12] with non-zero mean : 288.6238

ARIMA(0,0,1)(0,0,1)[12] with non-zero mean : 288.5743

ARIMA(0,0,0) with zero mean : 278.7719

ARIMA(0,0,0)(1,0,0)[12] with non-zero mean : 285.6014

ARIMA(0,0,0)(0,0,1)[12] with non-zero mean : 285.7997

ARIMA(0,0,0)(1,0,1)[12] with non-zero mean : 290.1935

ARIMA(1,0,0) with non-zero mean : 285.7561

ARIMA(0,0,1) with non-zero mean : 285.4466

ARIMA(1,0,1) with non-zero mean : 289.4372

Best model: ARIMA(0,0,0) with zero meanWhen plotting the residuals of the ARIMA model, we can see that the variance looks to be constant.

> plot(residuals(fitarima))

> title("Residuals of ARIMA Model")

Now, let us analyse a time series where ARCH is present — specifically air passenger numbers from DataSF Open Data.

Time series with ARCH present

The dataset used for this example is the Air Traffic Passenger Statistics dataset from DataSF Open Data, which is licensed under the Public Domain and Dedication License (PDDL). It was chosen to analyse historical air passenger data for British Airways — specifically for enplaned passengers travelling internationally to Europe from July 2005 to December 2022.

When running archTest once again, we can see that with a p-value of 0, the null hypothesis of no autoregressive conditional heteroscedasticity is rejected at the 5% level, indicating that ARCH effects are present in the time series.

> archTest(flights_ts)

Q(m) of squared series(LM test):

Test statistic: 559.1083 p-value: 0

Rank-based Test:

Test statistic: 315.6464 p-value: 0Let us fit an ARIMA model to the data and plot the residuals:

> # ARIMA

> fitarima<-auto.arima(flights_ts, trace=TRUE, test="kpss", ic="bic")

Fitting models using approximations to speed things up...

ARIMA(2,0,2)(1,1,1)[12] with drift : 3335.057

ARIMA(0,0,0)(0,1,0)[12] with drift : 3768.406

ARIMA(1,0,0)(1,1,0)[12] with drift : 3363.064

ARIMA(0,0,1)(0,1,1)[12] with drift : 3553.438

ARIMA(0,0,0)(0,1,0)[12] : 3763.431

ARIMA(2,0,2)(0,1,1)[12] with drift : 3321.197

ARIMA(2,0,2)(0,1,0)[12] with drift : 3389.068

ARIMA(2,0,2)(0,1,2)[12] with drift : 3325.333

ARIMA(2,0,2)(1,1,0)[12] with drift : 3369.368

ARIMA(2,0,2)(1,1,2)[12] with drift : 3333.489

ARIMA(1,0,2)(0,1,1)[12] with drift : 3313.035

ARIMA(1,0,2)(0,1,0)[12] with drift : 3383.34

ARIMA(1,0,2)(1,1,1)[12] with drift : 3339.011

ARIMA(1,0,2)(0,1,2)[12] with drift : 3317.092

ARIMA(1,0,2)(1,1,0)[12] with drift : 3365.819

ARIMA(1,0,2)(1,1,2)[12] with drift : 3333.249

ARIMA(0,0,2)(0,1,1)[12] with drift : 3452.153

ARIMA(1,0,1)(0,1,1)[12] with drift : 3307.936

ARIMA(1,0,1)(0,1,0)[12] with drift : 3379.521

ARIMA(1,0,1)(1,1,1)[12] with drift : 3334.918

ARIMA(1,0,1)(0,1,2)[12] with drift : 3312.17

ARIMA(1,0,1)(1,1,0)[12] with drift : 3360.67

ARIMA(1,0,1)(1,1,2)[12] with drift : 3328.116

ARIMA(1,0,0)(0,1,1)[12] with drift : 3305.58

ARIMA(1,0,0)(0,1,0)[12] with drift : 3378.07

ARIMA(1,0,0)(1,1,1)[12] with drift : 3332.445

ARIMA(1,0,0)(0,1,2)[12] with drift : 3309.485

ARIMA(1,0,0)(1,1,2)[12] with drift : 3325.783

ARIMA(0,0,0)(0,1,1)[12] with drift : Inf

ARIMA(2,0,0)(0,1,1)[12] with drift : 3310.926

ARIMA(2,0,1)(0,1,1)[12] with drift : 3316.098

ARIMA(1,0,0)(0,1,1)[12] : 3300.346

ARIMA(1,0,0)(0,1,0)[12] : 3372.808

ARIMA(1,0,0)(1,1,1)[12] : 3327.214

ARIMA(1,0,0)(0,1,2)[12] : 3304.261

ARIMA(1,0,0)(1,1,0)[12] : 3357.83

ARIMA(1,0,0)(1,1,2)[12] : 3320.579

ARIMA(0,0,0)(0,1,1)[12] : 3749.671

ARIMA(2,0,0)(0,1,1)[12] : 3305.756

ARIMA(1,0,1)(0,1,1)[12] : 3302.772

ARIMA(0,0,1)(0,1,1)[12] : 3558.329

ARIMA(2,0,1)(0,1,1)[12] : 3310.924

Now re-fitting the best model(s) without approximations...

ARIMA(1,0,0)(0,1,1)[12] : 3512.789

Best model: ARIMA(1,0,0)(0,1,1)[12]The model of best fit is determined as ARIMA(1,0,0)(0,1,1)[12].

Here is a plot of the residuals:

When looking at the above — we can see that the residuals showed the most volatility during 2020 when air passenger traffic fell dramatically due to COVID-19, along with increased volatility in 2010 following the financial crisis.

As such, we can see that the variance in the time series is clearly not constant over time. The series seems to have periods of relatively low variance followed by periods of high variance.

In this regard, let us use GARCH to model this volatility.

GARCH Forecast

Firstly, let us specify the GARCH model using the rugarch library in R.

> # start with default GARCH spec.

> library(rugarch)

> spec = ugarchspec() #the empty function specifies the default model.

> print(spec)

*---------------------------------*

* GARCH Model Spec *

*---------------------------------*

Conditional Variance Dynamics

------------------------------------

GARCH Model : sGARCH(1,1)

Variance Targeting : FALSE

Conditional Mean Dynamics

------------------------------------

Mean Model : ARFIMA(1,0,1)

Include Mean : TRUE

GARCH-in-Mean : FALSE

Conditional Distribution

------------------------------------

Distribution : norm

Includes Skew : FALSE

Includes Shape : FALSE

Includes Lambda : FALSE#Now, a volatility forecast can be conducted for 10 steps ahead:

> fit = ugarchfit(data = flights_ts, spec = spec, out.sample=10)

> forc1 = ugarchforecast(fit, n.ahead=10, n.roll = 10)

> forc1

*------------------------------------*

* GARCH Model Forecast *

*------------------------------------*

Model: sGARCH

Horizon: 10

Roll Steps: 10

Out of Sample: 10

0-roll forecast [T0=Feb 2022]:

Series Sigma

T+1 6876 1964

T+2 7680 1964

T+3 8428 1964

T+4 9124 1963

T+5 9772 1963

T+6 10374 1963

T+7 10934 1963

T+8 11456 1963

T+9 11941 1963

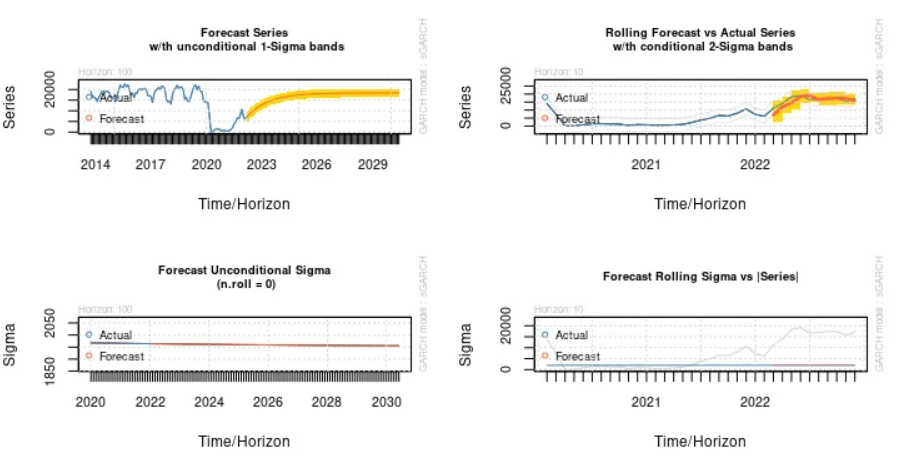

T+10 12392 1963Here is a plot of the forecasts:

We can see that the forecast series with unconditional 1-Sigma bands trends upwards — demonstrating a rebound in air passenger numbers following the COVID-19 pandemic. It should be noted that the forecasting model only seeks to forecast using the signal and not the noise from the specified time series. As such, we can expect that the forecast will be significantly less volatile than that of the time series itself.

For instance, let us lengthen the forecast to 100 steps ahead, and see what the forecast generates:

library(rugarch)

spec = ugarchspec() #the empty function specifies the default model.

print(spec)

fit = ugarchfit(data = flights_ts, spec = spec, out.sample=10)

forc1 = ugarchforecast(fit, n.ahead=100, n.roll = 10)

forc1

plot(forc1, which = "all")We can see that passenger numbers eventually smooth out, and ultimately oscillate within the range seen before the pandemic:

Of course, while we can expect that there could be significant deviations from the forecasted range over the forecasted period — the GARCH forecast is focusing on the overall signal rather than random noise in the series.

In this regard, we can see that GARCH is a useful tool for forecasting volatility in a situation where a simple ARIMA forecast would likely fall short due to the inability of the model to forecast periods of randomly high volatility.

Conclusion

In this article, we have seen:

How to test for ARCH effects using R

Plot and analyse ARIMA model residuals

Conduct a volatility forecast using GARCH

Many thanks for your time, and please let me know if you have any questions or feedback.

Are you interested in learning more about how to forecast business data using time series analysis? Book a free 30 minute consultation with me on Calendly.